Today is AUDUSD’s moment – sentiment slump does not stop the rally

Australia’s PCSI decline and a potential increase in the US PPI may become a trigger for the AUDUSD rate, with quotes likely to continue their ascent to 0.6260 after a correction. Discover more in our analysis for 11 April 2025.

AUDUSD forecast: key trading points

- Australia’s Thomson Reuters/Ipsos Primary Consumer Sentiment Index: previously at 52.39, currently at 49.30

- US Producer Price Index (PPI) for March: previously at 0.0%, projected at 0.2%

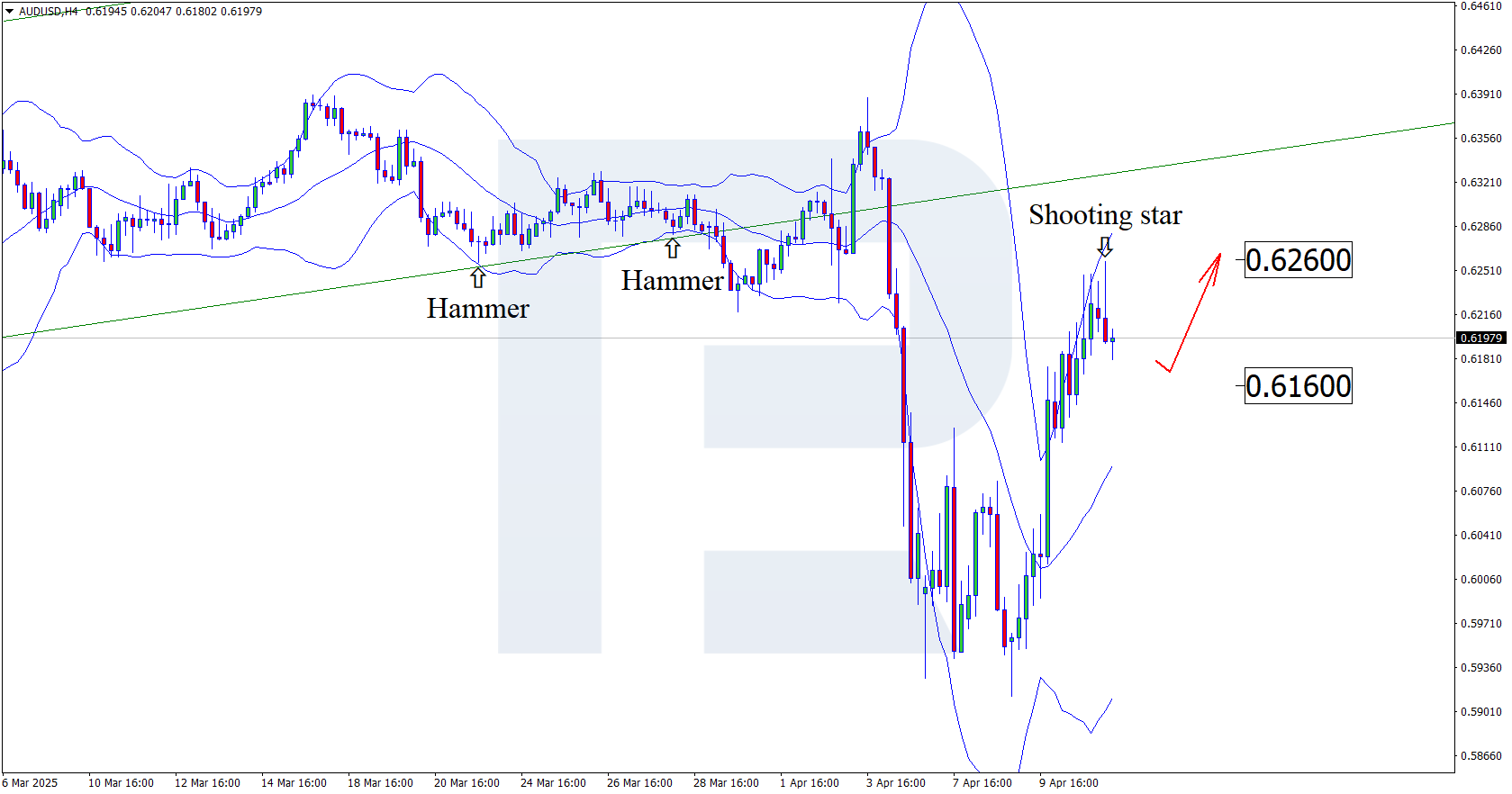

- AUDUSD forecast for 11 April 2025: 0.6160 and 0.6260

Fundamental analysis

Australia’s Thomson Reuters/Ipsos Primary Consumer Sentiment Index is a monthly barometer of Australians' confidence in the economy based on a population survey. It reflects residents’ assessment of their current financial standing, income prospects, willingness to spend, and overall economic perception. For traders and analysts, the index is an early indicator of potential shifts in consumer activity and domestic demand, which directly affects the AUDUSD rate.

Fundamental analysis for 11 April 2025 takes into account that the actual PCSI reading has fallen to 49.30 points.

The PPI is an inflation indicator tracking the average price change for goods and services of domestic producers. It records price changes from the sellers’ perspective and covers three production sectors: manufacturing, commodities, and processing. The PPI is often regarded as a leading inflation gauge, as rising costs for production and services typically filter through to consumers.

The forecast for 11 April 2025 suggests that the US PPI data could rise modestly to 0.2% from the previous period. Given today’s news, the AUDUSD forecast is rather optimistic, with the price likely to maintain its upward momentum after forming a corrective wave.

AUDUSD technical analysis

Having tested the upper Bollinger band, the AUDUSD price has formed a Shooting Star reversal pattern on the H4 chart. It is initiating a corrective wave following the received signal. Given strong gains in recent trading sessions, the pair will likely continue its upward trajectory to the next resistance level at 0.6260. A breakout above this level would open the door to further gains.

Alternatively, the AUDUSD rate could correct towards the 0.6160 support level before further growth.

Summary

Despite a dip in Australian consumer confidence to 49.30, fundamental drivers, including a potentially stronger US PPI, create a favourable backdrop for the AUDUSD pair. The AUDUSD technical analysis suggests the completion of the corrective phase and further growth to 0.6260.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.